What Is A Structured Settlement?

A structured settlement is simply a mechanism that allows plaintiffs to have a portion of their personal injury or wrongful death settlement paid out in future tax-free periodic payments.

The design of the payments is limited only to the imagination – giving the plaintiff complete flexibility in securing their financial future. Historically, damages from a personal injury or wrongful death lawsuit were paid in a single lump sum at the time of the settlement. This kind of payment placed plaintiffs and their families in the position of having to manage a large sum of money, which is often intended to provide for a lifetime of medical and income needs. Structured settlements were devised to alleviate the difficulty of this situation and to provide long-term financial security for families.

A structured settlement also makes it an ideal financial vehicle for many of life’s other fiscal challenges such as financing a child’s college education, planning for retirement, estate planning, responsible investing through dollar cost averaging, or fixed income investing.

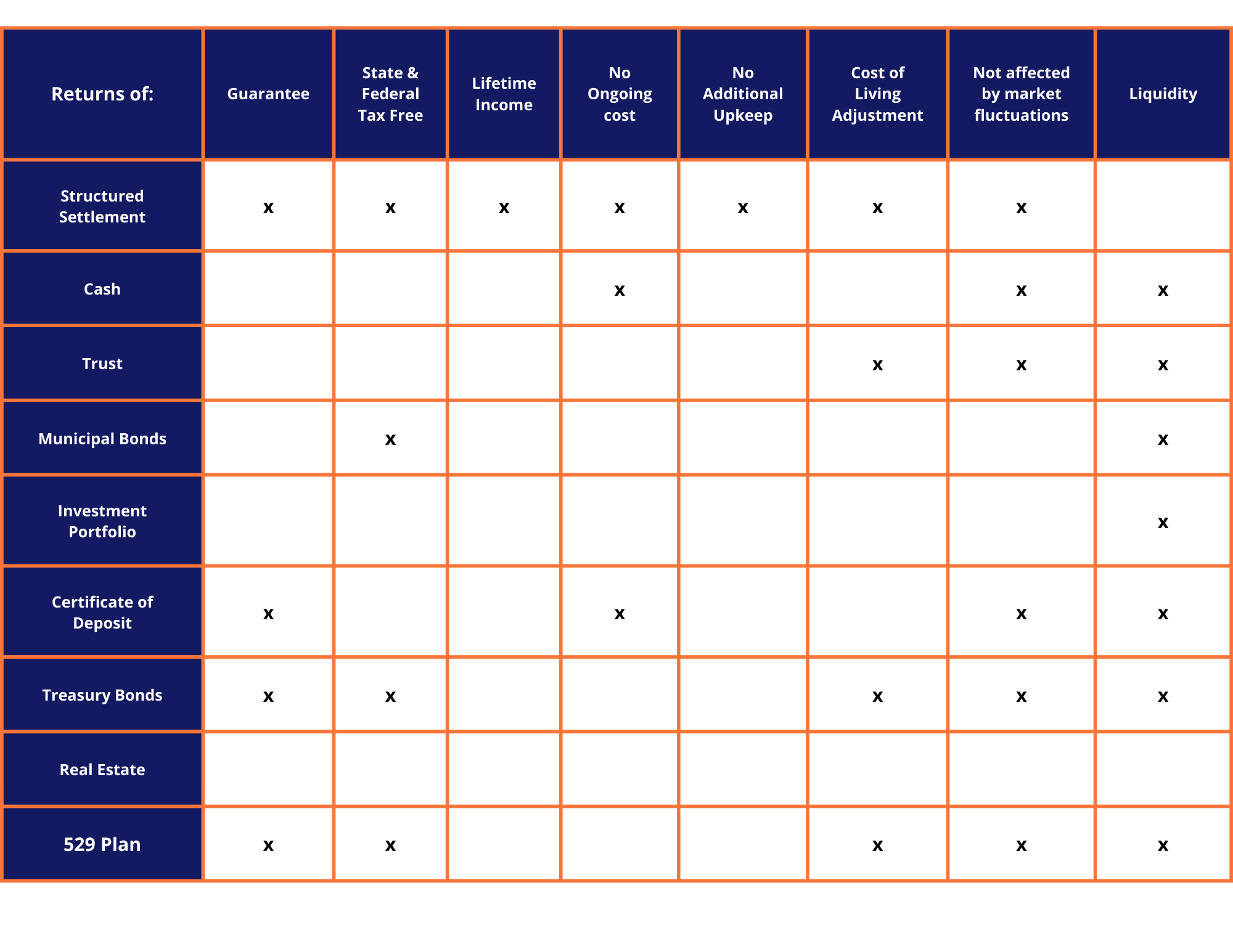

The Advantages Of A Structured Settlement

- Payments are a 100% tax-free including the interest

- No 1099 or any IRS reporting of the payments

- Flexible plan designs

- Super safe – guaranteed payments are insured through highly rated life insurance companies

- No fees or ongoing management expenses

- No probate . . . multiple beneficiaries may be named and payments remain tax free

- Peace of mind

- Protection from family, friends, divorce, lawsuits and bankruptcy (in most states)

Contact Us For More Information